End or Beginning?

For better or worse, the presidential election here in the U.S. is over and it was a clean sweep for the hard right. Now, as in Brexit, comes the aftereffects and more analysis. Was it disgust with big government, stagnant wages, misogyny, millennials and minorities not voting? Or was it simply a reflection of the hidden divide in this country, one that has lain buried for decades? And what will happen now? Will China and Russia seemingly coordinate with expanded efforts in both the South China Seas and Eastern Europe, testing both the NATO Alliance and PacCom? Will trade deals collapse and tariffs soar? And of course once again, no one really knows...the "analysts" and pollsters (notably Nate Silver who changed his mind over and over as the election results came in, thus creating a false "correct" prediction for his followers) were blindsided, so who's to say their future predictions are to be followed?

The move to the far right is appearing to be a trickle-down effect, however, as Europe begins to feel the shifting groundswell in countries such as Sweden, Austria, and much of Scandinavia. Here's what Market Watch had to say this morning about Europe's jitters: It is now surely clear that the globalized free-trading economy that has developed since the fall of the Berlin Wall in 1989 has left too many people behind. Wage growth has stalled, inequality has widened, and political elites, cocooned behind a wall of global institutions, have appeared increasingly remote...Take a look at Italy. Prime Minister Matteo Renzi faces a tricky referendum on constitutional reform early next month. It would now be a very, very foolhardy investor who viewed that as winnable — Renzi was already behind in the polls before Trump’s victory. Renzi took power in an internal party coup, and has yet to face a general election. If he is forced to call one, the likely victor is the Five-Star Movement — which is basically just Trump with better jokes. It is committed to a referendum on the country’s membership in the euro. The chances of that resulting in a vote to stay in? Above zero, perhaps — but not by very much. Remember this is a country that has been so impoverished by the euro that it is poorer now than in 2000...Next up France. It was already a done deal that National Front Leader Marine Le Pen would make the run-off for the presidential election next April and May. Her likely opponent is the center-right Alain Juppe — a politician who has been around so long, and has so much baggage, he is one of the few people in the world who could make Hillary Clinton look fresh and exciting. If America has a rust-belt problem, so does France – except it’s is even worse. The country’s manufacturing base has been steadily hollowed out since it joined the euro. The result? Mass unemployment and stagnant wages. The conventional wisdom has been that while Le Pen can capture a protest vote, she will never actually win an election. That must surely be toast now — and her commitment to restoring the old French franc has been steadfast...Not even Germany is immune. Angela Merkel may appear all-powerful, and national elections are not due until next autumn. But a politician whose most high-profile policy has been allowing mass immigration on an unprecedented scale looks very out of touch with the times. The right-wing Alternative for Deutschland is already making steady inroads into her support, forcing her to rely more and more on the center-left Social Democrats. It is hard to see that coalition lasting forever.

We are entering the great unknown as much in the world changes. Climate, science and migration might suffer while rallying cries of "defense" and isolationism begin to grow louder, even as our world begins to shrink. Hoarding of money might begin as markets begin to shift with the changes. But again, Market Watch seems to think not, that such emotional reactions and adjustments to change are typical throughout history (after Brexit and the fall of the pound, the currency appears to have settled). Opins financial columnist Chuck Jaffe: Donald Trump is now the personification of “political risk,” the potential for government decisions to damage the value of your investments, the chance that broad policy decisions will hit home...On the risk scale, however, investors historically put political risk way down their list of concerns. It’s a talking-head risk -- you hear a lot about it, and it makes for interesting discussions-- but the bigger worries involve the market, purchasing-power and longevity. Investors worry mostly about market or “principal risk,” losing money when a lousy investment or a bad market chews up their capital. Their next concern tends to be interest-rate risk or purchasing-power risk. President Trump doesn’t get to appoint a new Federal Reserve chairman immediately, so he can’t stop potential rate hikes from playing out; purchasing-power risk is the potential for your money to fail to keep up with inflation, a danger that is likely to be on the rise as the Fed pursues a target inflation rate of 2% by 2018...Longevity risk is about the potential to outlive your money, and the best way to mitigate it is to save and invest more (because the alternative would be to live less). That responsibility, like voting, falls on the shoulders of the individual and, as in the election, not everyone will be thrilled with their choices or the outcomes, but everyone should participate in the process.

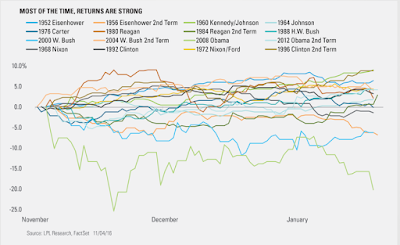

In another view from Market Watch, they highlighted a discombobulated chart from LPL Financials with this comment: When the party in power changes, the average move has been a decline of 2.97%, while the market has scored an average gain of 2.34% in the period when the same party retains the White House. Added the note from LPL Financial: The reality is if the economy is on firm footing and not in a recession (2008) or falling into a recession (2000), most (of) the time the returns have been rather strong for the S&P 500. Considering the economy currently is probably the best economy an incoming president has inherited since Clinton in 1992, this could be another plus for equities after this election.

So there you have it...more opinions (from both "experts" and me) and more analysis all of which basically amounts to more people guessing. Once again, no one truly knows what will happen. Here in the U.S., the voters have spoken; even those that didn't vote have spoken by not voting and now what happens happens. Personally I am happy to just have the chatter and media coverage over, the two-year campaigning becoming as irritating as tinnitus. Our country has a growing and evolving history of which this will prove just another part, and for better or worse, the election of 2016 is indeed now history. As the famous writer of the West, Louis L'Amour, wrote: The one law that does not change is that everything changes, and the hardship I was bearing today was only a breath away from the pleasures I would have tomorrow, and those pleasures would be all the richer because of the memories of this I was enduring.

The move to the far right is appearing to be a trickle-down effect, however, as Europe begins to feel the shifting groundswell in countries such as Sweden, Austria, and much of Scandinavia. Here's what Market Watch had to say this morning about Europe's jitters: It is now surely clear that the globalized free-trading economy that has developed since the fall of the Berlin Wall in 1989 has left too many people behind. Wage growth has stalled, inequality has widened, and political elites, cocooned behind a wall of global institutions, have appeared increasingly remote...Take a look at Italy. Prime Minister Matteo Renzi faces a tricky referendum on constitutional reform early next month. It would now be a very, very foolhardy investor who viewed that as winnable — Renzi was already behind in the polls before Trump’s victory. Renzi took power in an internal party coup, and has yet to face a general election. If he is forced to call one, the likely victor is the Five-Star Movement — which is basically just Trump with better jokes. It is committed to a referendum on the country’s membership in the euro. The chances of that resulting in a vote to stay in? Above zero, perhaps — but not by very much. Remember this is a country that has been so impoverished by the euro that it is poorer now than in 2000...Next up France. It was already a done deal that National Front Leader Marine Le Pen would make the run-off for the presidential election next April and May. Her likely opponent is the center-right Alain Juppe — a politician who has been around so long, and has so much baggage, he is one of the few people in the world who could make Hillary Clinton look fresh and exciting. If America has a rust-belt problem, so does France – except it’s is even worse. The country’s manufacturing base has been steadily hollowed out since it joined the euro. The result? Mass unemployment and stagnant wages. The conventional wisdom has been that while Le Pen can capture a protest vote, she will never actually win an election. That must surely be toast now — and her commitment to restoring the old French franc has been steadfast...Not even Germany is immune. Angela Merkel may appear all-powerful, and national elections are not due until next autumn. But a politician whose most high-profile policy has been allowing mass immigration on an unprecedented scale looks very out of touch with the times. The right-wing Alternative for Deutschland is already making steady inroads into her support, forcing her to rely more and more on the center-left Social Democrats. It is hard to see that coalition lasting forever.

We are entering the great unknown as much in the world changes. Climate, science and migration might suffer while rallying cries of "defense" and isolationism begin to grow louder, even as our world begins to shrink. Hoarding of money might begin as markets begin to shift with the changes. But again, Market Watch seems to think not, that such emotional reactions and adjustments to change are typical throughout history (after Brexit and the fall of the pound, the currency appears to have settled). Opins financial columnist Chuck Jaffe: Donald Trump is now the personification of “political risk,” the potential for government decisions to damage the value of your investments, the chance that broad policy decisions will hit home...On the risk scale, however, investors historically put political risk way down their list of concerns. It’s a talking-head risk -- you hear a lot about it, and it makes for interesting discussions-- but the bigger worries involve the market, purchasing-power and longevity. Investors worry mostly about market or “principal risk,” losing money when a lousy investment or a bad market chews up their capital. Their next concern tends to be interest-rate risk or purchasing-power risk. President Trump doesn’t get to appoint a new Federal Reserve chairman immediately, so he can’t stop potential rate hikes from playing out; purchasing-power risk is the potential for your money to fail to keep up with inflation, a danger that is likely to be on the rise as the Fed pursues a target inflation rate of 2% by 2018...Longevity risk is about the potential to outlive your money, and the best way to mitigate it is to save and invest more (because the alternative would be to live less). That responsibility, like voting, falls on the shoulders of the individual and, as in the election, not everyone will be thrilled with their choices or the outcomes, but everyone should participate in the process.

In another view from Market Watch, they highlighted a discombobulated chart from LPL Financials with this comment: When the party in power changes, the average move has been a decline of 2.97%, while the market has scored an average gain of 2.34% in the period when the same party retains the White House. Added the note from LPL Financial: The reality is if the economy is on firm footing and not in a recession (2008) or falling into a recession (2000), most (of) the time the returns have been rather strong for the S&P 500. Considering the economy currently is probably the best economy an incoming president has inherited since Clinton in 1992, this could be another plus for equities after this election.

| |

| Graph from LPL Financial showing changes from Election Day to Inauguration |

So there you have it...more opinions (from both "experts" and me) and more analysis all of which basically amounts to more people guessing. Once again, no one truly knows what will happen. Here in the U.S., the voters have spoken; even those that didn't vote have spoken by not voting and now what happens happens. Personally I am happy to just have the chatter and media coverage over, the two-year campaigning becoming as irritating as tinnitus. Our country has a growing and evolving history of which this will prove just another part, and for better or worse, the election of 2016 is indeed now history. As the famous writer of the West, Louis L'Amour, wrote: The one law that does not change is that everything changes, and the hardship I was bearing today was only a breath away from the pleasures I would have tomorrow, and those pleasures would be all the richer because of the memories of this I was enduring.

Comments

Post a Comment

What do YOU think? Good, bad or indifferent, this blog is happy to hear your thoughts...criticisms, corrections and suggestions always welcome.